Yesterday, I received an email from a business acquaintance that included an invoice. I knew this person and his business but did not recall him every doing anything for me that would necessitate a payment. I called him to about the email and he said that his account had been indeed hacked and those emails were not from him. What occurred was an example of business email compromise (BEC) using stolen credentials.

Typically, BEC is a form of cyber attack where attackers create fake emails that impersonate executives in order to convince employees to send money to a bank account controlled by the bad guys. According to the FBI, BEC is the costliest form of cyber attack, scamming business out of $1.7 billion in 2019 alone. One reason these attacks are becoming so successful is because attackers are upping their game: instead of creating fake email address that look like a CEO or a vendor, attackers are now learning to steal login info to make their scams that much more convincing.

By compromising credentials, BEC attackers have opened up multiple new avenues to carry out their attack and increase the change of success. Among all the ways compromised credentials can be used for BEC attacks, here are 3 that every business should know about.

Vendor Email Compromise

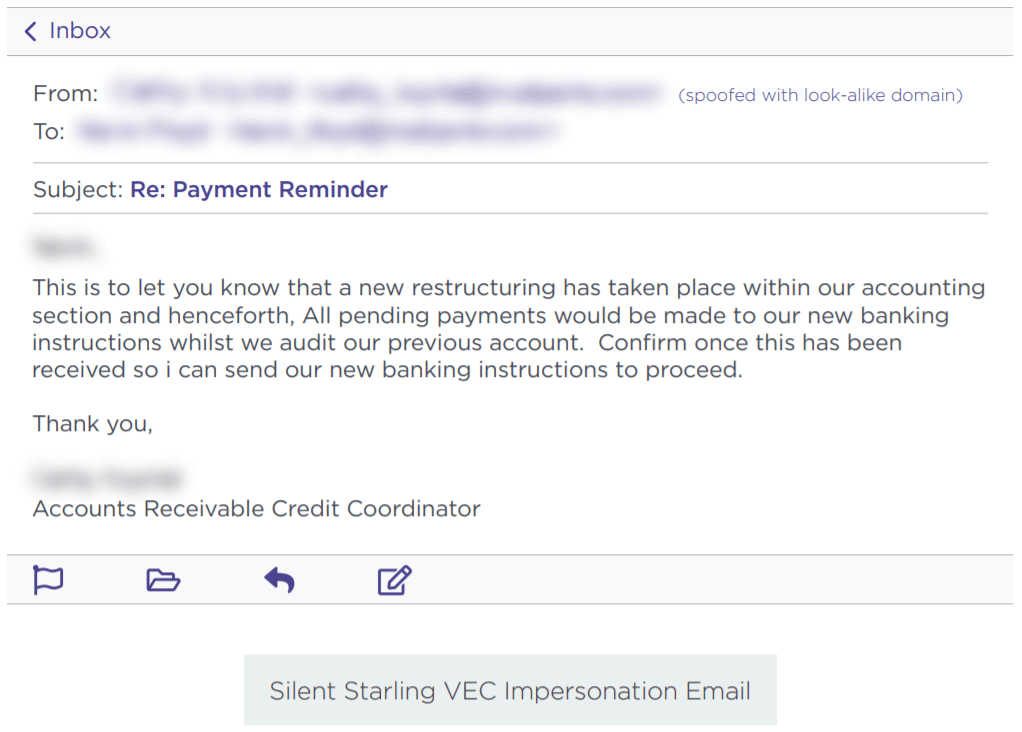

One way BEC attackers can use compromised credentials has been called vendor email compromise. The name, however, is a little misleading, because vendors aren’t actually the target of the attack. Instead, they are the means to carry an attack out on a business. Essentially, BEC attackers will compromise the email credentials of an employee at the billing department of a vendor, then send invoices from that email to businesses requesting they make payment to a bank account controlled by the attackers.

Inside Jobs

Another way attackers can use compromised credentials to carry out BEC scams is to use the credentials of someone in the finance or accounting department of an organizations to make payment requests to other employees and suppliers. By using the actual email of someone within the company, payments requests look far more legitimate and increase the change that the scam will succeed.

What’s more, attackers can use compromised credentials of someone in the billing department to even target customers for payment. Of course, if the customers make a payment, it goes to the attackers and not to the company they think they are paying. This is a new method of BEC, but one that is gaining steam. In a press release earlier this year, the FBI warned of the use of compromised credentials in BEC to target customers.

Advanced Intel Gathering

Another method to use compromised credentials for BEC doesn’t even involve using the compromised account to request payments. Instead, attackers will gain access to the email account of an employee in the finance department and simply gather information. With enough time, attackers can study who the business releases funds to, how often, and what the payment requests look like. With all of this information under their belt, attackers will then create a near-perfect impersonation of the entity requesting payment and send the request exactly when the business is expecting it.

Attackers have even figured out a way to retain access to employee’s emails after they’ve been locked out of the account. Once they’ve gained access to an employee’s inbox, attackers will often set the account to auto-forward any emails the employee receives to an account controlled by the attacker. That way, if the employee changes their password, the attacker can still view every message the employee receives.

What you can do

All three of these emerging attack methods attack should make businesses realize that BEC is a real and dangerous threat. It can be far harder to detect a BEC attack when the attackers are sending emails from a real address or using insider information from compromised credentials to expertly impersonate a vendor. Attackers can gain access to these credentials in a number of ways. First, through initial phishing attacks designed to capture employee credentials. Earlier this year, for example, attackers launched a spear phishing campaign to gather the credentials of finance executives‘ Microsoft 365 accounts in order to then carry out a BEC attack. Attackers can also pay for credentials on the dark web that were stolen in past data breaches. Even though these breaches often involve credentials of employees’ personal accounts, if an employee uses the same login info for every account, then attackers will have easy access to carry out their next BEC scam.

While the use of compromised credentials can make BEC harder to detect, there are a number of things organizations can do to protect themselves. First, businesses should ensure all employees—and vendors!—are properly trained in spotting and identifying phishing attacks. Second, organizations should require proper password management is for all users. Employees should use different credentials for every account, and multi-factor authentication should be enabled for vulnerable accounts such as email. Lastly, organization should disable or limit the auto-forwarding to prevent attackers from continuing to capture emails received by a targeted employee.

Businesses should also ensure employees in the finance department receive additional BEC training. A report earlier this year found an 87% increase in BEC attacks targeting employees in finance departments. Ensuring employees in the finance department know, for example, to confirm any changes to a vendor’s bank information before releasing funds, is key to protecting your organization from falling prey to the increasingly sophisticated BEC landscape.