Online scammers continue to use the COVID-19 crisis to their advantage. We have already seen phishing campaigns against the healthcare industry. The newest target? Small businesses. This week, the Small Business Administration Office of the Inspector General (SBA OIG) sent out a letter warning of an increase of phishing scams related to the new CARES Act targeting business owners.

CARES Act Loan Scams

The uptick in phishing scams imitating the SBA is primarily linked to the recent stimulus bill the government passed in response to the ongoing COVID-19 crisis. The bill, called the CARES Act, includes $350 billion in loans for small businesses. Given the current crisis, many businesses are eager to apply for loans, opening the door to new forms of phishing scams.

In addition, the scale and unprecedented nature of the loan program allows phishers to capitalize on the confusion surrounding the loan services. Last year, the SBA gave out a total of $28 billion, but now has to create a system to provide roughly 12 times that amount over the course of a few months. In order to help with the process, congress allowed the SBA to expand their list of loan venders. While this may help speed up the process, banks with no prior experience with SBA loan programs will now be distributing funds. Speeding up the loan process will help certainly ease the pain of many small businesses, but it also opens the room for errors, errors that scammers can use for personal gain.

What to Look For

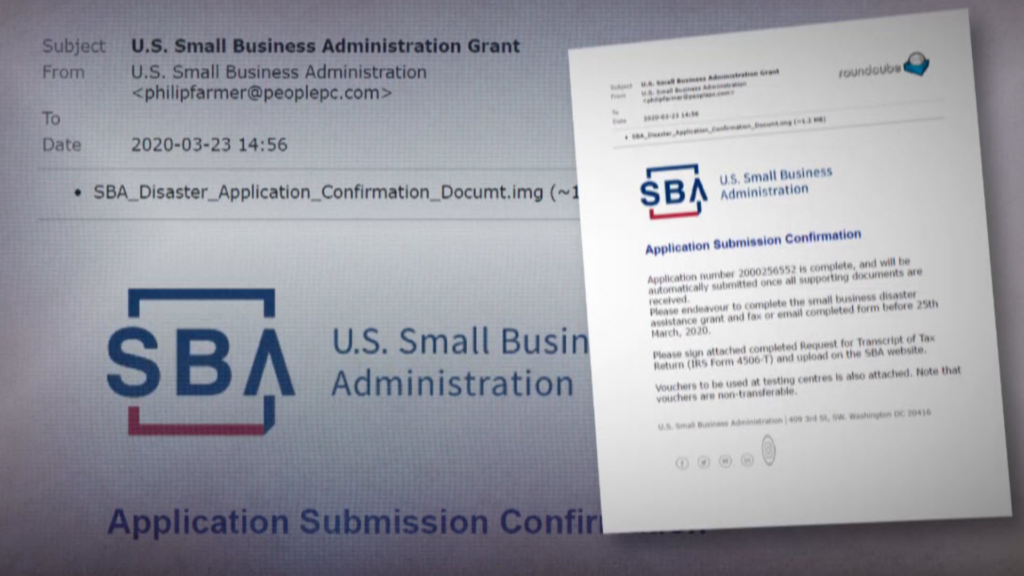

Business owners are already seeing this happen. A small businesses owner recently applied for a loan under the CARES Act to help keep her business running. Shortly after filing her application, her husband received an email stating they would need to fill out and return a tax statement to complete their application.

The email included the SBA logo and looked legitimate. However, on closer inspection, she realized the account number listed in the email did not match the one she received when applying for the loan, and the email address was not from a SBA email account.

Breathe in, Breathe O-U-T

This business owner was savvy enough to not fall for the scam, but others are likely to be tricked into handing over sensitive information or paying money to online scammers. In order to protect people against phishing campaigns, we recommend what we call the Breathe O-U-T Process:

- When you first open an email, first, take a Breath. That’s enough to get started because it acts as a pattern interrupt in automatic thinking and clicking (that leads to people biting the bait).

- Next, Observe the sender. Do you know the sender? Does their email address match who they say they are? Have you communicated with this sender before?

- Then, check Urls and attachments. Hover over the links to see if the URL looks legitimate. Be wary of zip files or strange attachments. If you aren’t sure if a URL is legitimate or not, just go to google and search for the page there instead.

- Finally, take the Time to review the message. Is it relevant? Does it seem too urgent? Does the information match what you already know? How’s the spelling? Be wary of any email which tries too hard to create a sense of urgency. In addition, phish are notoriously known for poor spelling and grammar. While we don’t all write as well as our fourth grade teacher, be careful when you see a lot of “missteaks”.

We’re living through strange and confusing times, and there are people out there who will use that to their advantage. Just taking a few extra minutes to make sure an email is legitimate could help save you a lot of extra time, worry, and money — none of which we can spare these days.

If you want to learn more about phishing scams and how to protect yourself, we are now offering the first month of our cyber awareness course entirely free. Just click here to sign up and get started.