by Doug Kreitzberg | Dec 10, 2021 | Cyber Awareness, Cybersecurity, Data Breach, Human Factor

This Fall, the personal health information of over 170,000 dental patients was exposed in a data breach associated with the Professional Dental Alliance, a network of dental practices affiliated with the North American Dental Group. According to the Professional Dental Alliance, patient information was exposed due to a successful phishing attack against one of their vendors, North American Dental Management. The phishing campaign gave attackers access to some of NADM’s emails, where the personal information of patients were apparently stored.

While the Professional Dental Alliance has said their electronic dental record system and dental images were not accessed, an investigation found that the protected health information of patients such as names, addresses, email addresses, phone numbers, insurance information, Social Security numbers, dental information, and/or financial information were accessed by the attackers.

This is not the first time dental offices have found themselves the target of a data breach. In 2019, a ransomware attack against a managed service provider resulted in the exposure of patient information from over 100 Colorado dental offices. A year later, the information of over 1 million patients was exposed after an attack against the Dental Care Alliance.

These incidents reveal just how vulnerable professionals can be against cybersecurity attacks and data breaches. One of the reasons for this is because many professionals are small businesses who don’t have the time or expertise to deal with everything that goes into cybersecurity. So, many professionals rely on vendors and associations to ensure they are protected. The issue is, if those vendors and associations experience a breach, professionals are also at risk.

To keep their patient information safe, it’s vital that dental offices and all professional businesses pay attention to some of the human risks that can lead to cybersecurity incidents. The attack this week, for instance, was the result of a phishing attack that tricked an employee into handing over account credentials. Here are a few things all professionals can easily do on their own to stay secure:

Endpoint detection and prevention

Endpoint detection and response (EDR) is a type of security software that actively monitors endpoints like phones, laptops, and other devices to identify any activity that could be malicious or threatening. Once a potential threat is identified, EDR will automatically respond by getting rid of or containing the threat and notifying your security or IT team. EDR is vital today to stay on top of potential threats and put a stop to them before they can cause any damage.

Multi-Factor Authentication

Using multi-factor authentication (MFA) is a simple yet powerful tool for stopping the bad guys from using stolen credentials. For example, if an employee is successfully phished and the attack gets that employee’s login information, having MFA in place for that employee’s account can stop the attacker from accessing their account even if they have the right username and password. If possible all users accessing your system should have multi-factor authentication set up for all of their accounts. At minimum, however, it is extremely important that every user with administrative privileges use MFA, whether they are accessing your network remotely or on-premise.

Patching

Hackers are constantly looking for vulnerabilities in the software we rely on to run our businesses. All those software updates may be annoying to deal with, but they often contain important security features that “patch up” known vulnerabilities. At the end of the day, if you’re using out-of-date software, you’re at an increased risk for attack. It’s therefore important that your team stays on top of all software updates as soon as they become available.

Back-ups

Having a backup of your systems could allow you to quickly restore your systems and data in the event of an attack. This is especially important if you are hit by ransomware, in which the attackers remove your data from your networks. However, it’s essential to have an effective backup strategy to ensure the attackers don’t steal your backups along with everything else. At minimum, at least one backup should be stored offsite. You should also utilize different credentials for each copy of your backup. Finally, you should regularly test your back-ups to ensure you will be able to quickly and effectively get your systems online if an attack happens.

Security Awareness Training

As this latest data breach shows, phishing and social engineering attacks are common ways attackers gain access to your systems. Unfortunately, phishing attacks are not something you can fix with a piece of software. Instead, its essential employees are provided with the training they need to spot and report any phish they come across. Sometimes it only takes one wrong click for the bad guys to worm their way in.

by Doug Kreitzberg | Apr 1, 2021 | Data Breach, Regulations

In the wake of the recent SolarWinds hack, a vendor compromise that infected tightly protected government agencies, the Biden administration is reported to be planning a new cybersecurity executive order as early this week. While a National Security Council spokeswoman said no decision has been made on the final content of the executive order, among the measures being reported is a new requirement that any vendors working with federal government agencies must report any suspected breaches to those agencies.

While there have been multiple previous attempts to establish breach notification laws through congress, industry resistance has previously been successful in halting the bills from passing. But now, following the two, massive hacks of SolarWinds and Microsoft over the past few months, there may not be much vendors can do to stop it this time.

Along with the breach notification requirement, the planned cybersecurity executive order is reported to contain a series of additional security requirements for software and programs used by federal agencies. This may include requiring federal agencies to take small, but essential security measures such as the use multi-factor authentication and data encryption.

Overall, the executive order appears to create broader levels of transparency and communication between software vendors and government agencies regarding cybersecurity. For example, since many pieces of software now link directly to other programs and services, the order is reported to also require a “software bill of materials” that lays out what the software contains and what other services it connects to. According to Reuters, the order may also create a cybersecurity incident response board, encouraging communication between government agencies, vendors, and victims.

If Biden signs the executive order, this may be a the first step towards a more robust and efficient response to the increasing cyber threats government agencies are facing. According to Reuters, this may also open the door towards broader public disclosure legislation. By being transparent and openly sharing information, both government agencies and private organization will benefit by helping to identify and mitigate threats more quickly and effectively.

by Doug Kreitzberg | Feb 12, 2021 | Data Breach, Incidence Response, Vendor Management

Breaches happen all the time, but every so often one of those breaches breaks through into national headlines, serving as a watershed moment about where we are and where we need to be with regards to cybersecurity.One of those watershed moments occurred last December when it was revealed that Russian state-sponsored hackers breached the software developer SolarWinds, and from there managed to access some pretty tightly-sealed networks and systems across public and private sectors. But what exactly happened? Who does it effect? What can we learn to better protect our organizations?

What Happened?

One of the most striking aspects of the SolarWinds hack is that it was years in the making, taking a huge amount of discipline and patience to pull off and stay undetected. Forensic evidence found that the hackers gained access to Orion, the SolarWinds product that was compromised, back in late 2019. Yet, at that time, the hackers didn’t actually make any changes or launch an attack. Instead, they sat and waited in order to monitor, learn, and test SolarWind’s system to ensure they wouldn’t be caught.

Then, months later in May 2020, the hackers made their move — but not in the way most would expect. Typically, when someone wants to infect a piece of software with malware, they will modify the code behind the software. However, because security experts know to look for code modifications, these hackers decided to instead install their malware directly onto the software product itself. So, when an update for Orion was released, government agencies, and companies big and small downloaded an update that contained a backdoor for the hackers.

Between May, when malware was initially launched, and December, when the hack was discovered, the attackers were able to move throughout the networks and systems of any company using SolarWinds’ software that they wanted. And they were targeted, going after the emails of specific, high-valued individuals within affected organizations. From there, the goal was to maintain access, move around infected system, and hold onto access of specific individuals’ communications.

Much has been made about the level of sophistication involved in the attack — and it was. However, at root, this is a story about 3rd party risk. We’ve written before about the importance of vendor management, and the SolarWinds hack is an extreme case in point. Because most organization’s today depend in large part on 3rd party providers for everything from cloud storage, to product platforms, to network security, an attack like this doesn’t have a definitive end. Instead, the SolarWinds attack has the potential ripple across a web of interconnected organizations across the supply chain. According to Steven Adair, a security expert who helped with the incident response for SolarWind, the attackers “had access to numerous networks and systems that would allow them to rise and repeat [the] SolarWinds [attack] probably on numerous different scales in numerous different ways.” It’s therefore possible — and perhaps likely — that the full effects of the hack are still to be revealed.

What’s Next?

If that doesn’t serve as a wake up call, we don’t know what will. And as it turns out, there are a number of effective and achievable steps organizations can take to mitigate 3rd party risk.

1. The Basics

It may not seem like much, but simply maintaining basic digital hygiene plays a big role in protecting against attacks. Strong password management, using multi-factored authentication, and network segmentation should be a cybersecurity baseline for all organizations. These are simple steps that serve as an organization’s first line of defense against an attack.

2. The Rule of Least Privilege

The rule of least privilege essential means providing the least amount of access for the least amount of time to systems and networks. This involves setting limits on what access you give to products and software as well as actively monitoring access privileges for employees, contractors, and vendors. Essentially, if something or someone doesn’t need access to a piece of your system, they shouldn’t be able to access it. If someone need access to a part of your network for 2 days, then their privileges should expire after 2 days. This will limit the ability for malicious users to move around systems, potentially preventing them from spreading to other, more sensitive environments.

3. Logging

A lot of organizations these days maintain event logs, which essentially keep a record of all network activity. While logs might not directly prevent a breach, these records are vital to asses the potentially damage and scope of an attack, allowing organizations to act swiftly and forcefully to remove the threat. However, keeping logs isn’t enough, it’s essential to also retain these logs. SolarWinds policy was to remove these logs after 90 days. The problem, of course, was that the attack was discovered far more than three months after the hackers breached the system, effectively making it impossible to gain any detailed insight into what the hackers were doing prior to August of 2020.

Combining Business and Security

We’ve said it before and we’ll say it again: it’s easy to see security needs as at best a nuisance and at worst a barrier towards optimal business performance, but this simply isn’t the case. As Steven Adair points out, a small company doesn’t need to hit the ground running with the best security products and a million code audits right out the gate. However, if businesses incorporate security concerns within business strategies, these organization can start to ask themselves: “Where are we now, what can we do now, and what can we do along the way?” Asking those questions might just make the difference down the road when the next watershed moment strikes.

by Doug Kreitzberg | Dec 9, 2020 | Business Email Compromise, Data Breach, Disinformation, Human Factor, Phishing

Yesterday, I received an email from a business acquaintance that included an invoice. I knew this person and his business but did not recall him every doing anything for me that would necessitate a payment. I called him to about the email and he said that his account had been indeed hacked and those emails were not from him. What occurred was an example of business email compromise (BEC) using stolen credentials.

Typically, BEC is a form of cyber attack where attackers create fake emails that impersonate executives in order to convince employees to send money to a bank account controlled by the bad guys. According to the FBI, BEC is the costliest form of cyber attack, scamming business out of $1.7 billion in 2019 alone. One reason these attacks are becoming so successful is because attackers are upping their game: instead of creating fake email address that look like a CEO or a vendor, attackers are now learning to steal login info to make their scams that much more convincing.

By compromising credentials, BEC attackers have opened up multiple new avenues to carry out their attack and increase the change of success. Among all the ways compromised credentials can be used for BEC attacks, here are 3 that every business should know about.

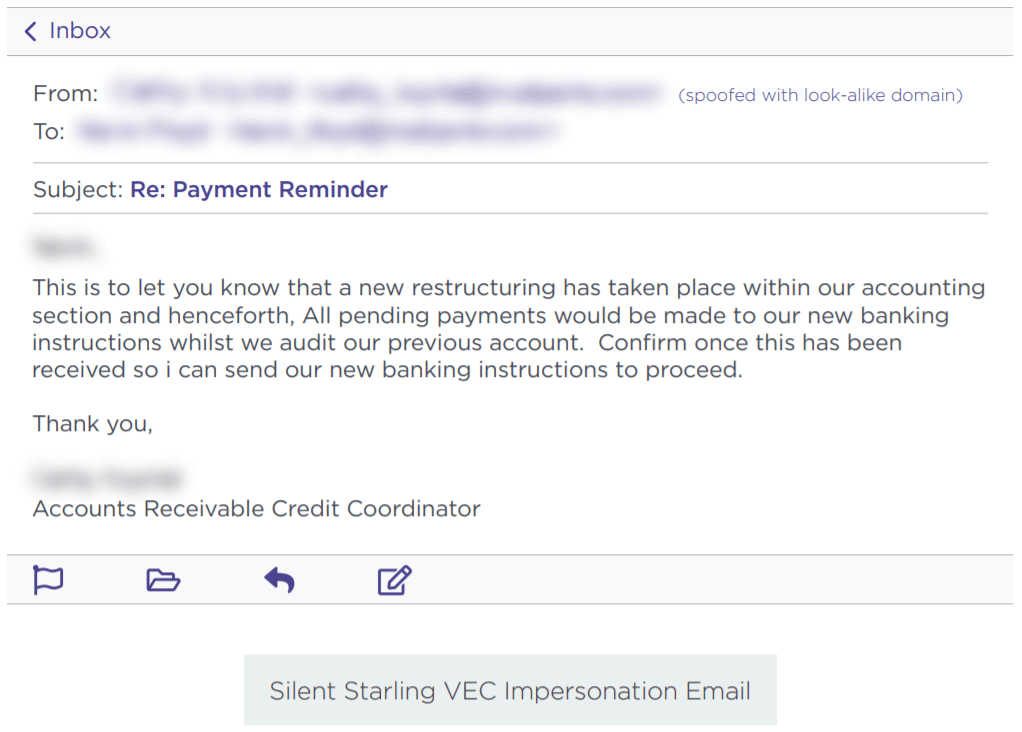

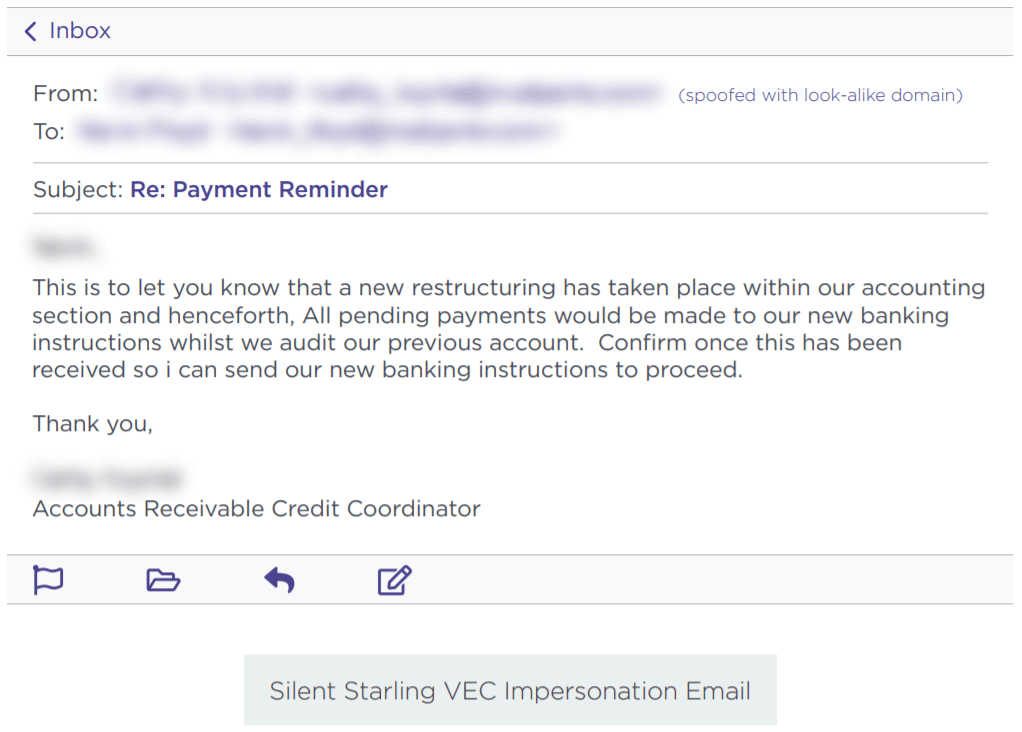

Vendor Email Compromise

One way BEC attackers can use compromised credentials has been called vendor email compromise. The name, however, is a little misleading, because vendors aren’t actually the target of the attack. Instead, they are the means to carry an attack out on a business. Essentially, BEC attackers will compromise the email credentials of an employee at the billing department of a vendor, then send invoices from that email to businesses requesting they make payment to a bank account controlled by the attackers.

Source: Agari

Inside Jobs

Another way attackers can use compromised credentials to carry out BEC scams is to use the credentials of someone in the finance or accounting department of an organizations to make payment requests to other employees and suppliers. By using the actual email of someone within the company, payments requests look far more legitimate and increase the change that the scam will succeed.

What’s more, attackers can use compromised credentials of someone in the billing department to even target customers for payment. Of course, if the customers make a payment, it goes to the attackers and not to the company they think they are paying. This is a new method of BEC, but one that is gaining steam. In a press release earlier this year, the FBI warned of the use of compromised credentials in BEC to target customers.

Advanced Intel Gathering

Another method to use compromised credentials for BEC doesn’t even involve using the compromised account to request payments. Instead, attackers will gain access to the email account of an employee in the finance department and simply gather information. With enough time, attackers can study who the business releases funds to, how often, and what the payment requests look like. With all of this information under their belt, attackers will then create a near-perfect impersonation of the entity requesting payment and send the request exactly when the business is expecting it.

Attackers have even figured out a way to retain access to employee’s emails after they’ve been locked out of the account. Once they’ve gained access to an employee’s inbox, attackers will often set the account to auto-forward any emails the employee receives to an account controlled by the attacker. That way, if the employee changes their password, the attacker can still view every message the employee receives.

What you can do

All three of these emerging attack methods attack should make businesses realize that BEC is a real and dangerous threat. It can be far harder to detect a BEC attack when the attackers are sending emails from a real address or using insider information from compromised credentials to expertly impersonate a vendor. Attackers can gain access to these credentials in a number of ways. First, through initial phishing attacks designed to capture employee credentials. Earlier this year, for example, attackers launched a spear phishing campaign to gather the credentials of finance executives‘ Microsoft 365 accounts in order to then carry out a BEC attack. Attackers can also pay for credentials on the dark web that were stolen in past data breaches. Even though these breaches often involve credentials of employees’ personal accounts, if an employee uses the same login info for every account, then attackers will have easy access to carry out their next BEC scam.

While the use of compromised credentials can make BEC harder to detect, there are a number of things organizations can do to protect themselves. First, businesses should ensure all employees—and vendors!—are properly trained in spotting and identifying phishing attacks. Second, organizations should require proper password management is for all users. Employees should use different credentials for every account, and multi-factor authentication should be enabled for vulnerable accounts such as email. Lastly, organization should disable or limit the auto-forwarding to prevent attackers from continuing to capture emails received by a targeted employee.

Businesses should also ensure employees in the finance department receive additional BEC training. A report earlier this year found an 87% increase in BEC attacks targeting employees in finance departments. Ensuring employees in the finance department know, for example, to confirm any changes to a vendor’s bank information before releasing funds, is key to protecting your organization from falling prey to the increasingly sophisticated BEC landscape.

by Doug Kreitzberg | Nov 11, 2020 | Data Breach

by Doug Kreitzberg | Oct 22, 2020 | Incidence Response, Risk Management, Uncategorized

Behavioral economics teaches us that we are more fearful of immediate losses than future gains. Conversely, we are also tend to choose immediate gains over protecting ourselves from future losses. Especially when the type of loss is too foreign to us or is ever changing.

We do have available to us a tool that doesn’t require a lot of tech to use but perhaps can do more to both enhance and protect our organization than any piece of software or hardware we might have: our imagination.

When things are changing, you can’t rely on static measures or processes designed to defend against what today’s threats. Because the use of technology as a business enabler is ever changing as is the nature of cyber threats, businesses need to take a dynamic approach to risk mitigation and transfer strategies and constantly imagine both the opportunities and the risks they may face tomorrow.

As a report from the UC Berkeley’s Center for Long-Term Cybersecurity and Booz Allen Hamilton states, “….failures of cyber defense in some cases — possibly the most important ones — [are] not necessarily a failure of operational rigor but equally or more so a failure of imagination.”

There are a number of tangible ways businesses can leverage the use of imagination in addressing the cyber risks that they may face. One is through an incidence response simulation. Get your team around a table. Imagine a ransomware event has occurred. What do you do? Do you pay the ransom? How long will your systems be down? How much business do you stand to lose? Brainstorm other scenarios, focusing on ones that could take you out. Risks that cause you to be shut down for an extended period of time or do irreparable harm to your ability to serve your customers or to your reputation.

Not only do these types of simulations help you be better prepared to respond if they occur, it also helps you better define what risks you might face and what defenses to build to mitigate those risks. This can therefore become the basis for your risk assessment (which, if you are simply focused on compliance you generally have to do anyway).

We often think of creativity when it comes to innovation and growth that are critical our long term success. In the ever-changing world of cyber threats, we need to be equally creative when it comes to imagining and addressing risks what are crucial for our long term viability.